How Governments Can Use American Rescue Funding to Come Back Stronger

The American Rescue Plan (ARP), a $1.9 trillion federal COVID-19 relief package enacted into law on March 11, 2021, includes $350 billion of funding for state and local governments to recover and rebuild from the pandemic -- representing one of the largest monetary injections to state and local budgets in decades. Broken down, these Fiscal Recovery Funds, aimed at providing equitable economic relief to cities, counties, states, territories, and tribes across the U.S., allocate $195.3 billion for states and the District of Columbia; $130.2 billion for local governments; $4.5 billion for territories; and $20 billion to federally recognized tribal governments.

Announced in March and officially adopted by the Treasury on May 10th, 2021, these funds are intended to provide much needed support to state, local, and tribal governments in responding to the impacts of COVID-19. They offer a critically needed fiscal boost to state and local governments that had barely bounced back to pre-2008 recession employment and spending levels before COVID hit; and a rare opportunity for cities, counties, and states, to not only fill budget holes in the present, but to make significant investments in the future, too.

State and local governments were among the hardest hit by COVID in terms of fiscal loss and job cuts, and the importance of the recovery funds to reviving public services and local economies cannot be overstated. As explained by the Economic Policy Institute, having made massive budget and staff cuts during COVID, state and local governments now face critically strained public services that “have serious implications for the health of local economies and the quality of life in [many hard-hit] communities.” Since the onset of the pandemic, cuts to the public sector workforce have been huge, with state and local employment as of February 2021 still 1.4 million jobs below February 2020 levels (Figure 1). Which, to put in perspective, the Economic Policy Institute notes is nearly 3x the state and local job losses than during the great recession.

Figure 1:

Source: EPI analysis of Bureau of Labor Statistics Current Employment Statistics public data series

With the funds, after bringing back and hiring on essential staff, governments should also have money leftover to address critical revenue losses and budget shortfalls. As similar to states and local governments being disproportionately hit hard by job cuts, government revenues - especially at the local level - were seriously strained. The National League of Cities notes that municipalities were hit hardest, and are now “confronting a massive FY20-21 revenue shortfall of $90 billion, which represents a steeper revenue decline than any recession in recent history.” While States, as noted by the Tax Policy Center, on average, suffered anywhere from a 1-10% drop in employment through April-December 2020 compared to the same period in 2019 (Figure 2); and a 1.8% decrease in total state revenues from the same time period in 2019 vs 2020. Comparably though, States fared slightly better than local governments when it came to revenue loss, thanks to the $600-a-week federal supplements that allowed people to keep spending, and states to keep collecting sales tax revenue. Plus, many states also received financial aid from the CARES act, while in contrast, many local governments - 30% according to a National League of Cities Survey - didn’t.

Figure 2: Year-over-year percent change in state-local government employment, April-December 2020 vs April-December 2019

Source: Tax Policy Center, Why States and Localities Need More Federal Aid, 2021

What Government Officials Need to Know About the State and Local Fiscal Recovery Funds

Building on previously enacted COVID-19 aid measures - the 2020 CARES Act, and the Consolidated Appropriations Act of 2021 - the $350 billion of funding for state and local governments within the American Rescue Plan allows recipients to use the funds to cover costs incurred by December 31, 2024 -- a hugely important timeline that will give governments ample time to address both present needs, and invest in smart solutions for the future. Listed below are the steps you can take now that funding is available and flowing quickly.

Step 1: Understand the funding guidelines and eligible uses

First released on March 11th, and clarified on May 10th, 2021 within the Interim Final Rule, the funding guidelines state the following eligible uses of funding:

- Support Public Health Response: Fund COVID-19 mitigation efforts, medical expenses, behavioural healthcare, and certain public health and safety staff.

- Replace Public Sector Revenue Loss: Use funds to provide government services to the extent of the reduction in revenue experienced due to the pandemic.

- Water and Sewer Infrastructure: Make necessary investments to improve access to clean drinking water and invest in wastewater and stormwater infrastructure.

- Address Negative Economic Impacts: Respond to economic harms to workers, families, small businesses, impacted industries, and the public sector.

- Premium Pay for Essential Workers: Offer additional support to those who have and will bear the greatest health risks because of their service in critical infrastructure sectors.

- Broadband Infrastructure: Make necessary investments to provide unserved or underserved locations with new or expanded broadband access.

Prohibited Uses of Funding:

- Changes that reduce net tax revenue must not be offset with ARP funds.

- Extraordinary payments into a pension fund.

You can read a full snapshot of funding requirements and eligibility in the Treasury’s Quick Reference Guide; and request your funds in a few easy steps through the online Treasury Submission Portal.

Step 2: Understand when and how your government will receive the money, and what information you will need to apply

Funding allocations have been updated as of May 25th, 2021, and are predetermined -- you can find the amounts for States and Counties here, allocations for local governments (cities) here, and allocations for non-entitlement units (local governments serving populations of 50,000 or below) here.

- Local Governments’ funding will be distributed by the Treasury in two parts -- 50% beginning in May 2021, and the second half approximately 12 months later.

- States and the District of Columbia, and Territories will receive allocations from the Department of Treasury within 1 business day of their submission being verified, which can take approximately 4 business days. Representatives for an eligible government can submit information for verification through the Treasury Submission Portal. For amounts and timelines for distribution, see here.

- Tribes’ funding will be distributed in two equal payments, with the first in May, and the second, based on employment data, to be delivered in June 2021. Representatives for an eligible government can submit information for verification through the Treasury Submission Portal.

- Non-entitlement units, or local governments serving a population of 50,000 or below, do not need to request funding from the Treasury, and will receive their allocated amounts (based on population calculations found here) through their state governments in two tranches. States will automatically receive non-entitlement unit allocations upon requesting their funds through the Treasury Submission Portal, and must then distribute these funds to local governments within 30 days.

You can request funds on behalf of your government now through a quick and simple online process -- you will just need the following information on-hand:

For state and local governments over 50,000 in population:

- Ensure your government has a valid DUNS number, a unique nine-character number used to identify your organization. If your organization is not yet registered, it is easy and free to do so: you can visit https://fedgov.dnb.com/webform/ to register.

- Ensure your government has an active SAM registration - the official government-wide database that permits you to do business with the U.S. government. Please note SAM registration can take up to 3 weeks, so register soon to avoid a delay in receiving your funds. You can find more information here.

- Your jurisdiction’s taxpayer ID number.

- Gather your organization’s payment information, including:

- Entity Identification Number (EIN), name, and contact information.

- Name and title of an authorized representative of the entity.

- Financial institution information (e.g., routing and account number, financial institution name and contact information).

- A completed certification document signed by an authorized representative.

Non-entitlement units (NEU’s), or local governments under 50,000 in population, do not need to request funding from the Treasury, but need to request funds from their state government. To request the first payment, NEU’s should be prepared to provide the information outlined in the Treasury’s Pre-Submission Checklist. Detailed information for both states and NEU’s on funding allocations can be found here.

Step 3: Build a strong business case for your allocation of funds, and be prepared to keep accurate and extensive records of your use of the money

- Given that COVID-19 impacted all sectors of government, the economy, and our communities in some way, there will undoubtedly be numerous departments vying for some of the funds. To secure funding for your project, you will need to build a strong business case that aligns your project to the funding objectives. And don’t wait - funds will move quickly!

- Make sure to keep accurate records and reports, as recipients will be required to submit an interim report, quarterly project and expenditure reports, and annual recovery plan performance reports regarding their utilization of funds. You can find out full details of what reporting will be required for your jurisdiction on page 14, here.

How State and Local Governments Can Use Their Funds

After a devastating year, the state and local fiscal recovery funds offer government organizations a once-in-a-generation opportunity to restore staffing levels and kickstart economic recovery. The pandemic pushed government technology adoption into high gear, and served as proof that digital governments can better adapt to sudden change. When society was turned upside down overnight with restrictions, government organizations that relied on technology to deliver critical services were able to continue supporting their community, while slower adopters were left scrambling for workarounds to being out of office. As explained by the Treasury, through the pandemic, governments experienced high demand for services while suffering greater job cuts than the 2008 recession. This severely impacted governments’ ability to provide critical public services that communities rely on for daily life, and that governments rely on to meet revenue targets. But now, with ARP funding available to support public services, governments can look to revive these services, and re-open important sources of revenue. So although getting back to former staffing levels is a start, it’s not the end game when it comes to driving forward economic recovery. Given the chance to build back better than before, governments should think about investing in future-proof technology that will improve revenue driving public services while making it easier for businesses and professionals to invest and work in their communities. This will ultimately contribute to governments’ ability to grow their tax base and support post-COVID economic recovery.

The question is not whether or not governments should invest in public services, but rather, where they should focus their efforts first, and how much money they should invest. The answer will differ from community to community, but for states that have experienced budget setbacks and licensing backlogs, and localities that rely heavily on development for revenue and community employment, investing in permitting and licensing services can be a big win.

Investing in Public Services & Economic Prosperity: Permitting and Licensing Potential

With permitting and licensing software, governments can transfer often entirely paper-based, siloed processes to the cloud, where all information can be easily accessed in one place. Not only can digital permitting and licensing improve public engagement and collaboration across departments and within teams, but can also simplify processes, and significantly speed up permit and license turnaround times. As a result of faster approvals and more straightforward processes, governments can collect fees more quickly and accurately; building and development projects move forward faster; businesses can more easily obtain a permit or license to operate; and professionals benefit from a straightforward and fast way to get their occupational license.

For all sizes of government, investing in permitting and licensing services can provide both short and long term benefits - here’s 3 reasons why:

Top 3 Reasons to Consider Investing in a Building Permitting Solution:

1. Additional Revenue:

- In a study on the economic impact of accelerating building permit processes on local development and government revenues, PricewaterhouseCoopers found:

-

Implementing a more responsive, digital permit process over a 5 year period could result in a 16.5% increase in property taxes, and a 5.7% increase in construction spending.

-

Overtime, these communities can gain millions in additional fees and tax revenue.

- In New York City, after introducing an online permitting platform in 2016, the Department of Buildings:

- Issued 13% more building construction permits than in FY 2014, and 40% more renewal permits;

- And as a result, saw a 26% increase in license, permit, and fee revenue from FY 2014 - FY 2018, totalling $257 million; and a 72% increase in general permit revenue over the same period.

-

2. Service Continuity and Excellence:

- Governments with cloud-based permitting processes in place, such as Orange County, California, have been able to offer the same, if not better services during the pandemic, and keep development revenues flowing. The County saw an increase in permitting volume in 2020, and was able to support a 10-day turnaround throughout the year.

3: Community Development:

- Nationwide, the demand for building permits, especially new residential construction permits, keeps growing (Figure 2).

- As explained by PricewaterhouseCoopers:

- Expediting the permitting process decreases costs to investors, in turn encouraging them to develop in communities where processes are streamlined, more affordable, and hassle-free.

- Shortening the permit process by 3 months on a 22 month project cycle could make the difference in whether or not a developer undertakes a project.

Figure 3: Building Permit Growth in the United States - January 2020 - April 2021

Source: United States Building Permits, Trading Economics

Top 3 Reasons to Consider Investing in a Licensing Solution:

1. Additional Revenue:

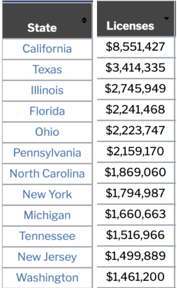

- State Licensing is a significant source of revenue (Figure 4), and improving and accelerating the process can bring in more money.

- In California, in 2019, the State received $62 million in physician application and renewal fees alone.

2. Quicker Turnaround Times:

- Over 25% of U.S. workers need an occupational license to work, so making the often complex and lengthy process more straightforward will knock down current barriers for job entry, and save both staff and applicants valuable time. With a rush to vaccinate and deliver other essential services, an expedited, online process is critical.

3: Make it Easier to Start a Business or Go Back to Work:

- With quicker approval times, new businesses can start up without worries of delays resulting in revenue loss; and those who need a license to work can quickly obtain one without hassle, preventing unlicensed work from being carried out.

Figure 4: State tax collections by source ($ in thousands), 2016

Source: State Government Tax Collections by Source, Ballotpedia, 2016

Source: State Government Tax Collections by Source, Ballotpedia, 2016

Ultimately, as explained in more detail in The Economic Case for Permitting and Licensing Software, for governments looking to allocate some of their ARP funding to improve public services while also making up for fiscal loss, digitizing permitting and licensing is a good place to start. By consolidating permitting and licensing services into one online platform, governments can vastly improve cross-department communication and collaboration; better analyze data to find inefficiencies and improve operations; increase engagement with the public through easy online access to services; and fast-track applications and approvals to drive community development and economic growth.